- +27 (0)56 212 6161

- freepen@e3.co.za

It is important that all members understand the benefits which the Fund offers you and the investment strategy implemented by the Trustees.

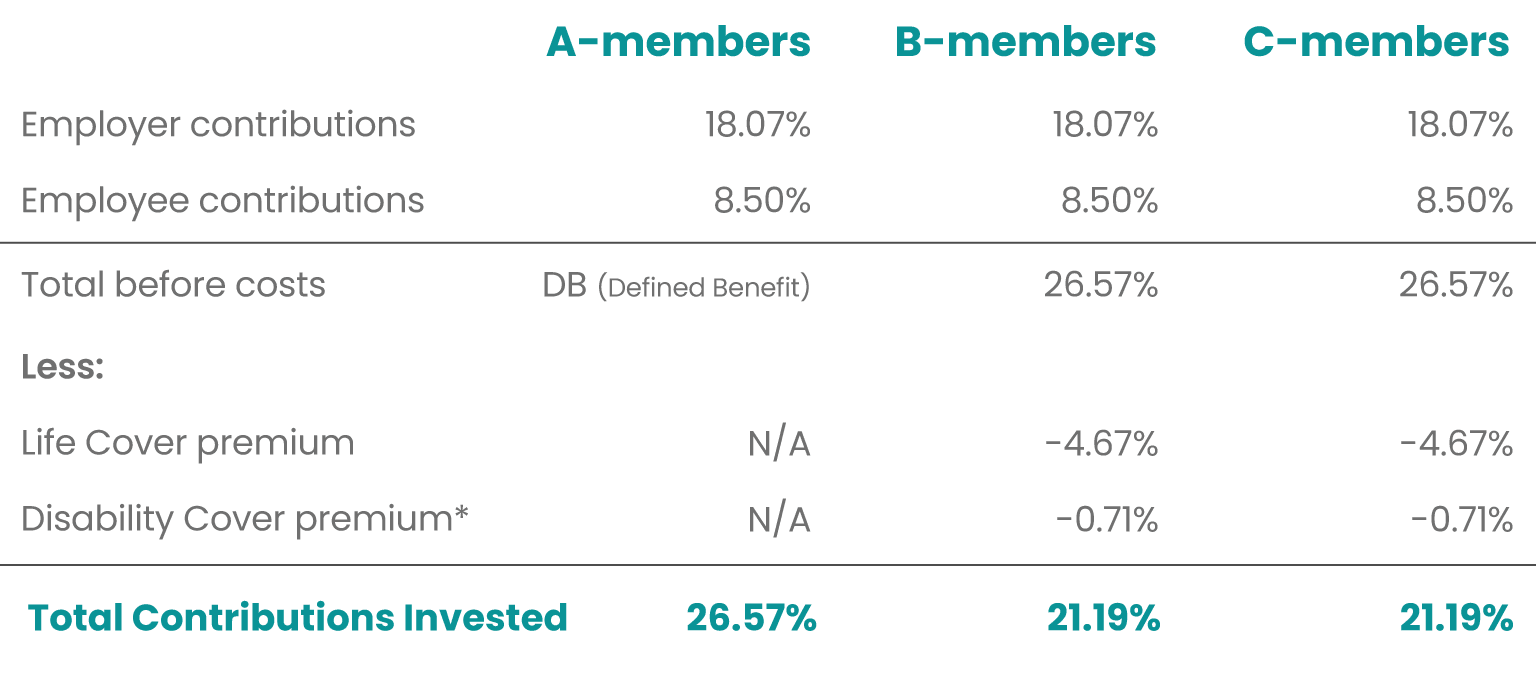

The table below details the current contribution rates:

* This premium is not payable after age 60 as the Disability cover ceases at 60.

Pensionable Age: 65 years, with early retirement allowed from age 55.

Pensionable Service: Period of Service with the Local Authority for which contributions were paid, plus Bonus Service as per the Rules.

Pensionable Emoluments (PE): The remuneration of the member in terms of the Rules of The Fund. For the purposes of this report, the PE has been referred to as pensionable salaries.

Final Pensionable Salaries (FPE) for Category A members: Annual Average Pensionable Salary during the last two years of Pensionable Service. For C-members annual pensionable salary increases are declared by the actuary on an annual basis.

Member’s Share ( Category B and C): The amount transferred on conversion plus net retirement contributions and investment returns.

Pension (at 65):

2.5% of FPE for each year of Pensionable Service. Members may commute pension for cash but certain rules apply for members younger than age 55 on 1 March 2021.

Gratuity (at 65):

7.72% of FPE for each year of Pensionable Service.

Member’s Share is available to secure a pension.

Commutation options are available.

Deferred Benefit:

The pension and gratuity are based on FPE for A-members.

Defined contribution:

Member’s Share is available to secure a pension. Commutation options are available.

A spouse’s pension of 75% of the members pension if death occurs after age 58.

A spouse’s pension of 75% of the members pension if death occurs after age 58.

Lump Sum:

1.5 times Pensionable Salary (Provided member under age 60) plus the Gratuity outlined above.

Spouse’s Pension:

1.2% of Pensionable Salary based on prospective Pensionable Service to age 60.

Children’s pensions are also payable in certain circumstances.

Member’s Share, plus 5 times Pensionable Salary if death occurs prior to age 60.

Defined Benefit:

The pension and gratuity as for A-members.

Defined Contribution:

Member’s Share, plus 5 times Pensionable Salary if death occurs prior to age 60.

Your lump sum death benefits are paid according to the Pension Funds Act. All factual and financial dependency on you is considered when determining the distribution of your death benefits. The Trustees of the Fund are responsible to decide on the allocation and distribution of your death benefits.

Please ensure that you have completed your beneficiary nomination form. Although the Trustees determine the allocation according to your financial and factual dependents, they are obliged to take your wishes into account when they make this decision.

Without a completed form, your wishes cannot be considered!

You can submit your completed form to the Principal Officer at hazel@axiomatic.co.za or the Front Office at freepen@e3.co.za.

Member’s contributions plus 6% for each year of Contributory Service including Bonus Service increased by 20% for each complete year of Pensionable Service in excess of five years to a maximum increase of 200%; provided that for a Member with five or more years Pensionable Service this amount may be further increased by the Executive Committee after consulting the Actuary.

This benefit is subject to the Minimum Individual Reserve as outlined in the legislation.

Member’s Share

This benefit is subject to the Minimum Individual Reserve as outlined in the legislation.

Deferred Benefit:

As for A-members

Defined contribution:

Member’s Share- this benefit is subject to the Minimum Individual Reserve as outlined in the legislation.

Our asset allocation process is designed to achieve optimal sustainable long-term investment returns at a level of risk, that the Board considers acceptable, and which is cognisant of our pay-out obligations.

A liability-driven investment approach is followed, which addresses interest rate risk, inflation risk, mortality risk, and longevity risk combined with a multi-portfolio “life stage” approach with each portfolio having different return objectives and risk characteristics.

Asset liability modeling is used to set the asset allocation for each portfolio, a process designed to achieve optimal sustainable long-term investment returns at an acceptable level of risk, and which is cognisant of our pay-out obligations.

Risk is managed through position sizing and a well-diversified multimanager investment structure spread across geographies, asset classes, and within asset classes. Investments are approached in a responsible manner, incorporating sustainability considerations.

Investment managers are monitored dynamically, including a comparison to benchmark and peer groups.

Regulation 28 is compliant at the member and Fund levels.

Category A Members are invested in a combined portfolio made up of Growth assets and a liability-driven strategy to match the investment strategy post-retirement. The overall strategy is to ensure the fund holds sufficient assets to support the retirement benefit for Category A members.

Category B Members and the part of Category C Members which are in the defined contribution structure are invested in the Life Stage Model, which consists of:

The Growth Portfolio focuses on long-term capital growth and aims to achieve returns of inflation plus 5 over 5-year periods.

This portfolio is utilised to manage members’ assets that are more than 5 years from retirement. In other words, all members aged 60 years or younger will be fully invested in this portfolio.

The Conservative Portfolio has more of a focus on capital protection given the shorter investment horizon (members are closer to retirement age). In addition to the primary objective of protecting capital, the portfolio will aim to achieve returns of inflation plus 3 over 3-year periods

This portfolio is utilised to manage members’ assets that are less than 5 years from retirement.

The Life Stage model aims to consider the different risks and needs of investors close to retirement (5 years or less to retirement) and younger members still further from retirement age (more than 5 years). Because of the distinct difference in the risk appetite of members close to retirement (5 years or less) and younger members (more than 5 years from retirement), there are two separate portfolios utilised for both Category B and C members.

This portfolio is utilised to manage members’ assets that are more than 5 years from retirement.

In other words, all members aged 60 years or younger are fully invested in this portfolio.

This portfolio is more focused on capital protection and in addition to the primary objective of protecting capital, the portfolio still aims to achieve returns of inflation plus 3% over 3-year periods.

This portfolio is utilised to manage members’ assets that are less than 5 years from retirement.

The table below explains how the life stage works:

100% Free State Growth Portfolio.

Capital Accumulation.

Transition quarterly over a 3-year period.

100% Free State Conservative Portfolio.

Capital Protection.

The life stage is a default strategy whereby all members below the age of 60 will be 100% invested in the growth portfolio.

When a member reaches the age of 60 (5 years prior to retirement) they will enter the default life stage. In the default life stage, on a quarterly basis and over a 3-year period, members will (in equal percentages) be automatically switched from the growth to the conservative portfolio.

When a member reaches the age of 63, they will be 100% invested in the conservative portfolio and remain invested in that portfolio for the last 2 years until their retirement date. The life stage model happens automatically and does not require members to make any decisions.

It is important to also consider that some members may have different needs from others and therefore the option to not participate in the default life stage is provided for. Should a member wish not to participate in the default (de-risking into the conservative portfolio), the option to “opt-out” will be available to the members. In other words, if a member wished to stay invested in the growth portfolio up until their retirement date, such a member will be afforded the opportunity to exercise that option.

How does the Fund handle your Personal Information?

By now you will no doubt have received numerous emails from businesses updating you on how they are complying with the Protection of Personal Information Act (POPIA) which came into full effect on 1 July 2021.

Together with our Service Providers to the Fund in providing you with retirement funding benefits, we have security measures in place to safeguard your personal information when communicating with the Employer and you as a Member. This is to comply with POPIA which is a law that enforces a person’s constitutional right to privacy by regulating the collection, use, sharing, storage, and destruction of personal information.

What do you need to know about your Personal Information and the Fund?

Security measures will apply to all recipients of our communications, this means you and the Employers. We will never send emails that have personal, identifiable information in the main text. Instead, we will include the personal information in secure PDFs attached to the email.

This means that the recipient will need a password to open the attachment and view the communication. The password will be a decryption key specific and familiar to the recipient of the document, meaning that all recipients will receive a password in a separate email in order to access the password-protected document.

The purpose of PAIA is to give effect to the constitutional right of access to information held by any private or public body that is required for the exercise or protection of your rights.

PAIA provides you with the right of access to information held by public and private bodies when you request such information in accordance with the provisions of PAIA, for the exercise or protection of any of your or another person’s rights.

If you make such a request, a public or private body must release the information unless PAIA or any other relevant law, states that the records containing such information may not be released.

The Funds PAIA Manual is detailed below:

1. Introduction

This Cookie Policy explains how we use cookies and similar technologies on our website www.vrystaat-munisipale-aftreefonds.co.za. This policy is designed to help you understand what cookies are, how we use them, and the choices you have regarding their use.

2. What Are Cookies

Cookies are small text files that are stored on your device (computer, tablet, or mobile phone) when you visit certain websites. They are widely used to enhance your online experience by remembering your preferences and actions over time. Cookies are not harmful and do not contain personal information like your name or payment details.

3. How We Use Cookies

We use cookies for various purposes, including:

4. Your Cookie Choices

You have the option to manage your cookie preferences. You can usually modify your browser settings to accept, reject, or delete cookies. Please note that if you choose to block or delete cookies, some features of our website may not function properly.

5. Third-Party Cookies

We may allow third-party service providers to use cookies on our website for the purposes outlined in Section 3. These providers may also collect information about your online activities over time and across different websites.

6. Updates to This Policy

We may update this Cookie Policy from time to time to reflect changes in technology, law, or our data practices. Any changes will become effective when we post the revised policy on our website.

7. Contact Us

If you have any questions about our Cookie Policy or how we use cookies on our website, please contact us at freepen@e3.co.za

By continuing to use our website, you consent to the use of cookies as described in this Cookie Policy.

An essential aspect of the governance of the Fund is that complaints are managed properly. This is also one of the outcomes of the Treating Customers Fairly initiative of the Financial Sector Conduct Authority which is applicable to all retirement funds. In what is set out below the process for managing complaints is set out.

For the purposes of this Policy, a complaint: